Ok, let’s talk about COVID-19. As I write this, it is the summer of 2020, and we are in the midst of the second wave of the outbreak here in the United States. We have a patchwork governmental response that varies highly from state to state, and even city to city. Factual reporting on the pandemic is the exception rather than the rule, and non-expert opinions and anecdotes abound. Both fear and hubris are in strong supply. Infections and deaths in the US are higher than in many other countries, and some would argue higher than they should be in a first-world, developed nation with access to modern healthcare tools and techniques. In other words, it’s not exactly what we thought the world would look like when we started planning this trip several years ago.

I’m sure some of you are thinking that it is irresponsible to be traveling around the country right now, others may be curious what precautions we are taking, so that you can plan a similar trip. I’ll share our opinions, tactics and techniques related to this topic, but please accept the fact that COVID-19 has different impacts in different parts of the country, and also on people with different health risk factors. The research on the virus is ongoing, with new details emerging frequently. If our knowledge about the pandemic changes, our plan will too. This is our take, it may or may not work for you, and I encourage you to plan and take actions that are best for you and your family.

To set the stage, we started planning this trip several years ago, and the thought of a global pandemic contingency plan didn’t cross our mind back then. Our original planned departure was in March/April of 2020. As the impact and severity of the pandemic was growing and becoming known at that time, we pushed back our date. Eventually, and with much thought and contemplation (and a lot of back up plans), we decided to begin our journey in June. We made several changes to our original plans, but felt like it was still something we wanted to do.

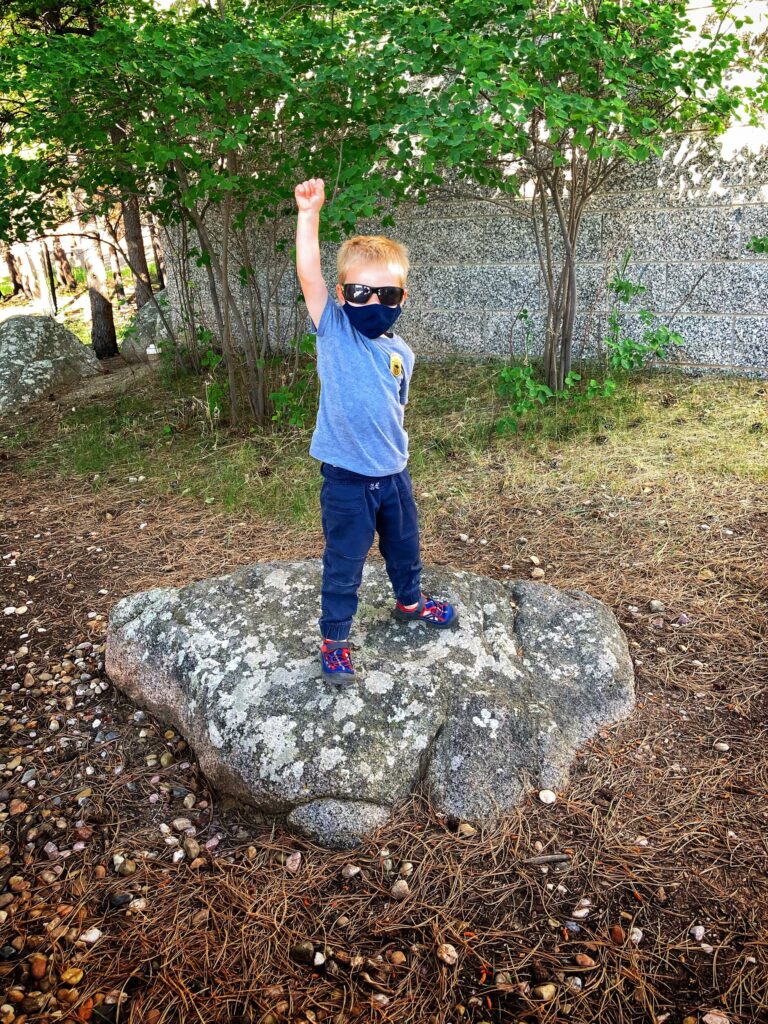

So first off, if you are not aware, we travel with a truck and a 30ft RV travel trailer. This enables us to greatly reduce (but not totally eliminate) contact with others. We have not been using airlines, we rarely stay at hotels and we cook most of our meals at or in the RV. Wherever we go, we strictly adhere to, or exceed all local regulations and laws for travel, masks and social distancing (Owen included). We avoid indoor public spaces where we are likely to encounter others whenever possible. We do curbside pickup for anything we can (groceries, etc), and plan ahead to minimize the number of orders/trips. If we must enter an indoor space with other humans, we always mask up, and keep the amount of time indoors to a minimum. We also wear masks outdoors if we are expecting to encounter other people (for example, when we visited Mount Rushmore or when we are on busy or narrow hiking trails).

Next, I’d like to talk about societal inequality. Our family falls more on the risk-averse side of the risk spectrum (which I’ll talk about later), but traveling during a pandemic isn’t just about our safety. We represent a risk to the communities that we visit. Some of the employees who are working at establishments we patronize (gas stations, stores, etc) might not have the means or option to isolate at home for their safety. We are conscious of this fact, and try to be respectful to the local communities. This is a balancing act however, because many of the cities we are visiting have economies largely based on tourism, and from a financial perspective they have been especially hard hit by the shutdown or slowdown. We want to support these communities through economic activity, but not put them at undue risk from encounters with a family that has been traveling. In short, we try to recognize the risk we represent and balance our net positive/negative impact on the local community.

The Risk Spectrum. We believe that, inside the bounds of a community’s laws and regulations, everyone’s behavior is largely governed by where they fall on the “Risk Spectrum”. On one end you have Risk Averse and on the other, Risk Tolerant.

Imagine something like this:

Each person may have different risk tolerances for different activities. For example your investing risk tolerance might be different than your COVID-19 risk tolerance. For COVID-19, Super Risk Averse might look like only leaving home for true emergencies, and having zero physical contact with other humans. The other side of the spectrum might be something like going to a small, crowded, indoor bar, filled with strangers, in a high case-count area, where no one is wearing masks.

As for us, we are more towards the Risk Averse side of the spectrum, but not at the far edge of it. This means we venture out into the world, but avoid contact as much as practical and keep our distance. It means we do take Owen to outdoor parks and playgrounds, but we choose to leave if more than one or two other families are present. It means we do, on occasion, get together with small groups of friends or family if we are mutually comfortable sharing space and air with each other. It also means we choose to avoid most indoor establishments, and it means we are less social with campground neighbors and fellow travelers than we might be otherwise. We also choose to spend more time in places with lower population densities, and lower case counts. All of these choices are informed by our understanding and current knowledge about viral transmission, as well as each location’s regulations.

It’s also important to consider the emotional impact of traveling right now. While we might be seeing lots of new places, we are not seeing lots of people, at least not in the sense that we are able to make meaningful connections. Kristy and Owen are both very social people (me slightly less so), and limiting interactions has been tough. It is difficult to take Owen to a park, only to leave when several other kids arrive. Owen gets so excited to make new friends, and it is heartbreaking to feel like we have to discourage that right now. We talk openly with him about the pandemic, and while he may not grasp the enormity of it, he does understand what’s going on. As much as we don’t want social distancing guidelines to become his view of what’s normal forever, we take some small solace in the fact that pretty much all American children are experiencing the same thing. It’s still hard though. So we do zoom calls, and briefly chat with campground neighbors from 15 feet away, and just like everyone else, we try and make the best of it while staying safe.

An additional element of our approach to traveling right now is staying informed on the progression of the pandemic. We frequently check case counts for the area we’re in, or are heading to soon. We adjust our travel plans if we are uncomfortable with the numbers. We acknowledge the fact that these stats are lagging indicators and may not tell the whole story for a region. We do our best to keep up with the current scientific consensus of viral transmission and prevention, and act accordingly. This is not always easy. There is a lot of misinformation out there, as well as well-meaning, but outright wrong opinions. So we take in news and information from a variety of different reputable sources and then we do our best to make an informed decision about our future plans and actions. We accept that traveling right now is not a risk-free proposition. We also believe that if our only view of the world is through the lens of the news media and social media, we would have a skewed view of reality, and so we choose to go out into the world, and see it for ourselves.

Finally we have a lot of backup plans. Our travel plans are not set in stone, and we have the flexibility to quickly make changes. These plans range from simply avoiding certain areas to scrapping the trip and choosing a safe place to settle down and wait it out. We feel we have a variety of options available to us should our situation change, and this gives us the peace of mind and confidence to proceed with the trip.

So that’s it! Well, not really, but that seems like a good place to stop for now. We always knew this trip would present us with unexpected challenges, and in that regard we were certainly correct. Our knowledge and approach to travel in the time of COVID-19 is continuously evolving, and as such, I reserve the right to update this blog post if and when our perspectives change!